February often feels like the “in-between” month.

The holidays are behind us.

January’s fresh-start energy is fading.

And tax season is quietly picking up speed.

For many small business owners, this is when bookkeeping starts to feel… overwhelming.

But here’s the good news: February is actually one of the best months to get your finances organized—before things get stressful.

Let’s talk about why this month matters and what you can do right now to stay ahead.

Why February Matters for Your Books

By February, most businesses:

✔ Have a full month of real data from the new year

✔ Are receiving tax documents (1099s, W-2s, statements)

✔ Are thinking about last year’s taxes

✔ Are already juggling new goals and daily operations

If your books aren’t clean now, small issues can quickly turn into big headaches by March and April.

A little attention in February can save you a lot of time, money, and stress later.

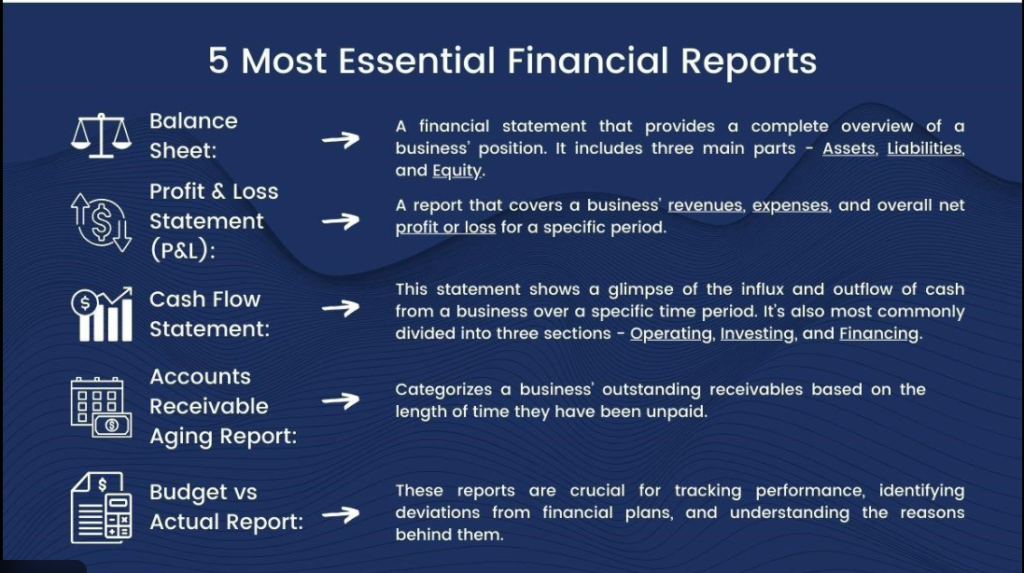

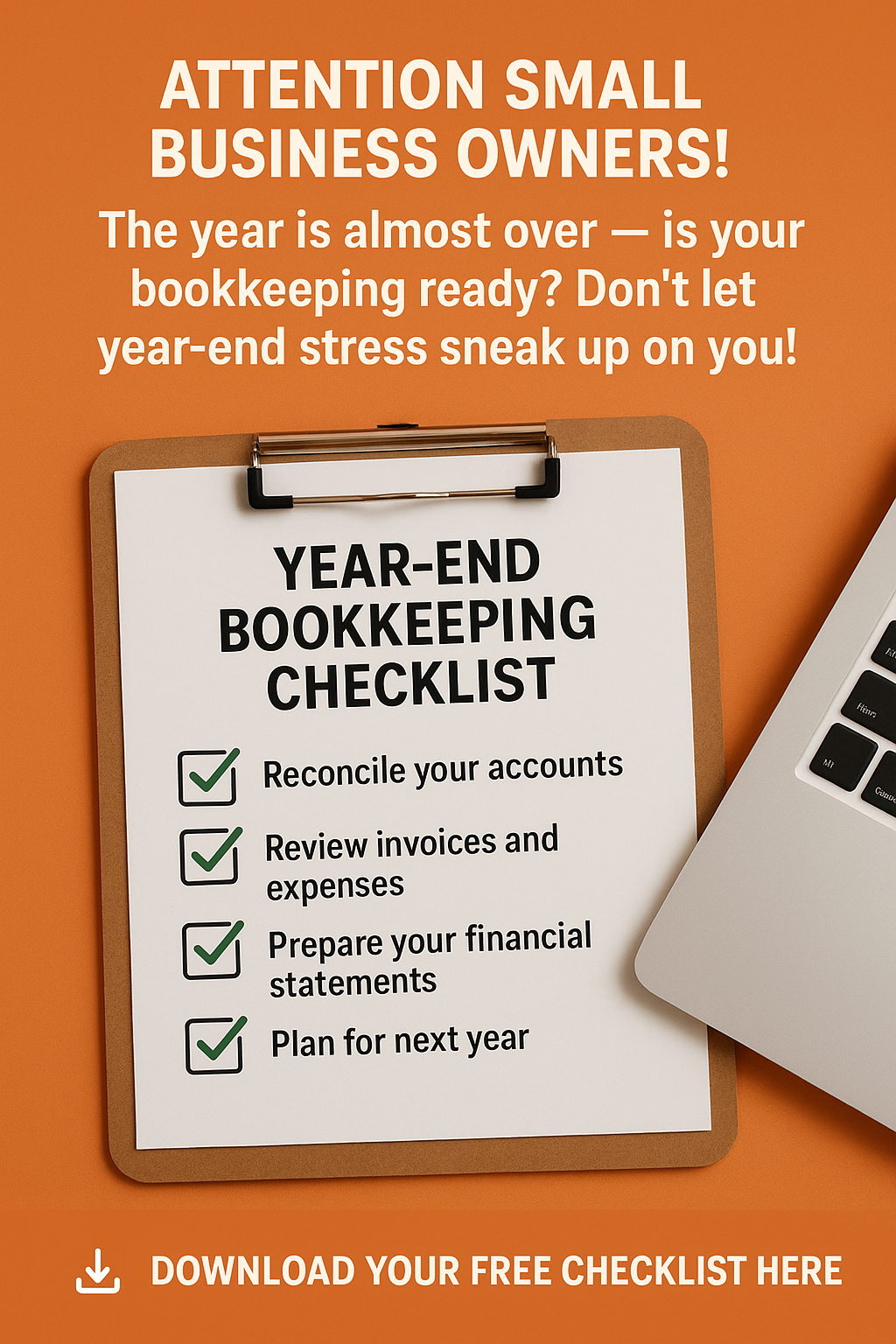

5 Smart Financial Moves to Make This Month

1. Reconcile January Completely

Make sure all January bank and credit card accounts are reconciled.

This confirms:

- Your balances are accurate

- No transactions are missing

- No duplicates or errors exist

If January isn’t clean, everything after it will be harder.

2. Review Last Year’s Records

Before tax filing ramps up, check that:

- Income is categorized correctly

- Expenses are properly recorded

- Owner draws/payments are accurate

- Loans and liabilities are up to date

Catching issues now prevents last-minute scrambling later.

3. Organize Your Documents

Create a simple digital folder for:

- Bank statements

- Credit card statements

- Receipts

- Payroll reports

- 1099/W-2 copies

Organization saves hours when reports or tax questions come up.

4. Check Your Cash Flow

February is a great time to ask:

💡 Are invoices being paid on time?

💡 Are expenses creeping up?

💡 Do you have enough reserves?

Understanding your cash flow early helps you plan confidently for the year ahead.

5. Set a Simple Monthly Routine

Consistency is everything in bookkeeping.

Try this monthly habit:

✔ Upload documents

✔ Reconcile accounts

✔ Review reports

✔ Ask questions early

Even 30–60 minutes a month makes a big difference.

Common February Bookkeeping Struggles (You’re Not Alone)

Many business owners tell me:

“I’m behind and don’t know where to start.”

“I’m scared something is wrong.”

“I’ll deal with it later.”

Here’s the truth: Most messy books aren’t caused by neglect. They’re caused by being busy.

Running a business is hard. You’re doing your best.

Getting help isn’t failure—it’s smart leadership.

How Professional Bookkeeping Helps Right Now

Working with a bookkeeper in February can help you:

✔ Prepare for tax season

✔ Avoid penalties and surprises

✔ Improve cash flow

✔ Make better business decisions

✔ Gain peace of mind

Instead of guessing, you’ll know exactly where your business stands.

Let’s Make This Your Strongest Financial Year Yet

February isn’t about perfection.

It’s about progress.

Small steps now lead to smoother months ahead.

If your books feel overwhelming—or you just want reassurance that everything is on track—I’m here to help.

📩 Reach out anytime to schedule a review or consultation. Contact

Let’s make this year organized, confident, and profitable.

Helpful Resources

Internal Revenue Service Small Business Tax Guide